(news & commentary)

Let’s start off with the good news: despite downturns in overall sales of their two key products (semiconductor equipment and cameras), Nikon managed to finish their year with increased profits. The bad news: they didn’t meet estimates they made as recently as February, as I suspected would happen. In the Imaging Company, the key there was:

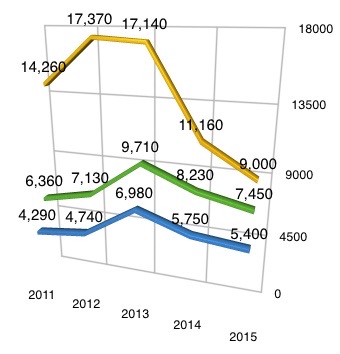

- DSLR/mirrorless estimate 6000, actual 5750 units

- Lens estimate 8400, actual 8230 units

- Compacts estimate 11,500, actual 11,160 units

Nikon attributed the drops to “market conditions” in China and Europe. Nikon finished the year with 34% of the interchangeable lens camera market (up), 31% of the lens market (about same), and 27% of the compact market (slightly up). In terms of all cameras: 29% of all cameras sold.

For those who want to know what game Nikon played in their financial presentation (see this article if you don’t know what I’m talking about), it was Hide the Bad Quarter. You have to look deep in their presentation materials to see that 4th quarter (Jan-Mar of 2014) was the worst sales quarter for cameras and lenses for Nikon since the same quarter in 2012. And by far: 19% lower than last year’s same quarter.

Throughout Nikon’s year-end report there was good news, bad news, often on the same presentation slide or report page. For example, camera/lens inventories dropped by 25% while cash rose, but debt grew. Or: for the coming year camera/lens sales will be down but profit up.

Nikon predicts that all DSLR/mirrorless sales will drop 6%, as will their sales in that market. In other words, they’ll retain market share in a modestly declining market. With lenses, however, things are worse. The overall market they predict to drop 5%, but their sales will drop 9.5%. They see their sales of compacts dropping 19% while the overall market slides 25%, meaning they expect to gain share in compacts again.

So how do they get increased profits (though only modestly) on fewer sales? “Product mix optimization and cost reduction.”

I loved these lines in their risk section, though: "The Nikon Group is making utmost efforts to protect and enhance the 'Nikon Brand,' which was fostered over years of corporate management marked with integrity and provision of products and services that are worthy of customer trust. However, there is a possibility that the Group's profit and financial position will be adversely affected should trust in the brand decline and the value of the Nikon brand be damaged, as a result of the circulation of negative reputation or evaluation of the Group's technologies, products or services.” Right. D800 focus problems. D600 dust problems. D4 focus controller problems. V3 EVF problems. Maybe they finally understood this might have an impact?

But here’s the real issue for Nikon:

Blue is DSLR/mirrorless, green is lenses, yellow is compacts.

Note that I think Nikon’s 2015 estimates are a bit optimistic, too. They’re expecting a “recovery” in the second half of the year, but I don’t really see any products driving that recovery. Sure, Photokina 2014 kicks off that second half of Nikon’s fiscal year, but Nikon is essentially predicting that we’re nearing the bottom of the drop in camera adoption. I’d bet against that without evidence of a new disrupting technology reigniting the market.

Many of you may remember that I used the following analogy: that the camera market was at the end of the straightaway and headed for a hairpin curve. Nikon wasn’t braking. Well, now they are, though they’re projecting they don’t have to hit the brakes hard.

Also interesting is what I’m hearing from sources inside and close to Nikon. The inventory build-up I pointed out in Stuff the Channel is being attributed by Nikon corporate to subsidiaries claiming they could sell more than they could (that has bad implications for the Japanese heads of those subsidiaries when they return to management in Japan). In other words, subsidiary managers were over optimistic ordered more of products than could be sold and corporate built to that. What’s happening now is that corporate is apparently doing all subsidiary allocation themselves, which is why we suddenly see something like the AW1 and V3 being out of stock quickly after introduction here in the US (it didn’t help that half the EVFs that shipped to the US for the V3 needed to be recalled).

Okay, what’s that tell us about Nikon’s connection to users? Right, it’s broken. Neither the subsidiary (overly optimistic) nor corporate (overly cautious) actually know what the customer wants and will buy.

So what else did Nikon’s presentation tell us? How about:

- Nikon thinks they can maintain share in a declining market. Probably true, though the fact that they just had a really bad quarter in cameras and lenses and they’re projecting better is a little worrisome.

- The hope of a lot of new lenses is low. The steep decline in lens sales is perplexing, but then again, I’ve written time and again that Nikon doesn’t know what DX lens mix to produce, and it isn’t quickly addressing lenses that are long in the tooth in FX, either. So you have to believe now that this is on purpose. Which seems really strange from a company where everything they do revolves around optics.

- New products will likely be in short supply. Nikon’s product introductions are coming at higher prices and with more cautious initial shipments. Heaven help us if they introduce a great D7100, D300s, D700, or D800 replacement. You’ll have to club all the others scrambling to get one if you want one the day it appears.

- There’s a tension between “cost reduction” and “reputation of the brand’s products”. Frankly, all those previous cost reductions have reduced my expected quality of the product I receive. Since about 2009 I’ve been seeing more and more issues with out-of-box Nikon gear that could have their root cause pinned on something that might have been because of a cost reduction. Prior to that, we had some failures, sure, but they were often because of a parts supplier who delivered problematic parts that eventually failed (e.g. D70s BGLOD and D2h meter death). Personally, I want to see a complete reversal of the pattern that’s been occurring lately. But doing that while reducing costs is tough.

Right now, I expect Nikon to miss their 2015 unit shipment estimates in cameras (but not in lenses). It will be a stressful year that starts on the heels of a bad quarter.

Is Nikon in trouble? No. Operationally, they’re still well within the bounds of expectations for pretty much all the key financial measurements. Cash is decent, debt-to-equity ratio okay, ROI okay, and so on. But Nikon has to manage to something else now. From 2007 to 2013 it was running like a growth business. Now it has to run like a mature business in a flat or declining market. Today’s presentation in Tokyo was the first time I saw any indication that Nikon management understands that. Now they have to prove they can do it.