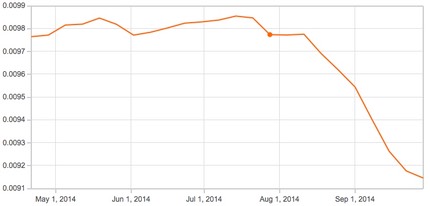

After having a very flat run through the first half of the year, the yen/dollar relationship is now once again changing as the yen loses value. While it had a more volatile year, the Thai Bhat/dollar relationship is also dropping.

What do those two things mean? Well, for DSLRs, it means that Nikon likely now has some pricing flexibility in the US due to currency exchange. Quite a bit, it would seem.

But we’re in the first month of the quarter. I really doubt sales have drooped enough for Nikon to immediately add in stronger rebates here in the US. They’ll wait to drop prices with Black Friday at the end of November, I think, and probably mostly with older products, especially ones due for replacement or retirement*.

Between Thanksgiving and the end of the year, I expect quite an aggressive pricing situation in the US from virtually all the camera companies. So keep your pocket books closed for a month or so, folks.

In Europe it’s a different story. The yen has been been a bit more steady against the Euro this year. The room for more aggressive pricing without giving up gross product margin is not there. On the other hand, Europe sliding closer to recession again means fewer sales, so perhaps we’ll see sales there, too.

One of the things on every Japanese consumer electronics company financial report that’s up front and center is the role of currency on profits. Because these companies are primarily exporters, they’ve learned to game the currency fluctuation situations pretty well. Indeed, it’s not unusual to see much of their actual profits generated by currency differential that was played correctly. So Nikon, et.al., won’t give all that yen decline back in savings to US customers, but they’ll certainly use some of it to keep sales up.

You can already see some of the “play” going on. If you look at August’s DSLR shipments to Europe, it’s 47% of last year’s number, while it’s 88% for the Americas. Even though mirrorless is said to be doing better in Europe than the US, the same thing plays out: 100% of last year’s shipments to Europe, 132% of last year to the Americas. In other words, more inventory is coming into the area with the bigger currency gain against the yen/bhat and less into the one with the flatter currency rates. It’s not just because the US economy is more healthy; it’s also that the yen/dollar relationship allows the camera companies to be a little more aggressive with sales.

That said, it’s more important to the Japanese companies what happens in Asia itself: there’s been a slow shift of more volume into Asia and away from Europe/Americas that shows no sign of letting up.

* But not the D300s ;~). I’ve been studying Customs databases that show imports into the US by vendor/product, and Nikon is bringing in very small quantities of D300s at a time. There’s apparently no excess inventory they really need to unload.