(news & commentary)

No sooner did I post the previous two articles relating to unit volume and shipments, CIPA released the final year-end numbers for 2015.

Let’s start with the Big Picture this time. If we add up all the cameras and lenses sold by the Japanese companies in 2015, we get US$1.34b. This isn’t a small industry, though it’s declining. Declining by how much? Well, 2015’s total value shipped was only 93.3% that of 2014. That’s a modestly strong contraction, and it follows on a stronger contraction from the previous year: 2015 is 79.9% of 2013 in terms of dollar volume for the Japanese camera companies.

The notion that “making higher priced products will save the industry” that has been cited all over the Internet and by many camera company marketing departments is mostly inaccurate. Higher prices generate fewer sales. What does happen is that—assuming you can pare down your fixed overheads—your margins get restored. I see that over and over in the Japanese company’s financial reports: lower sales, but profits that are moving back upwards due to cost cutting and higher GPMs. At some point, however, this tactic no longer works, though. It’s a short term response at best.

Put another way, the lake is drying up. Far fewer fish are swimming in the lake, and those fish are bigger and eat more. If the lake keeps drying up, you still have problems.

Here are the numbers expressed in two ways:

- 2013 — 17.1m ILC units shipped, US$1.67b total camera/lens shipments

- 2014 — 13.8m ILC units shipped, US$1.43b total camera/lens shipments

- 2015 — 13.0m ILC units shipped, US$1.33b total camera/lens shipments

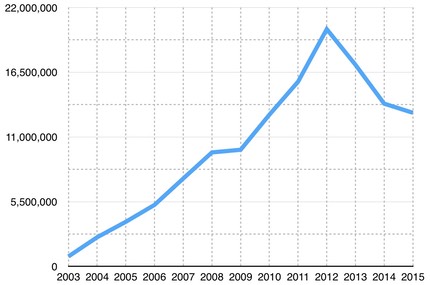

So let’s talk about ILC cameras specifically. That would be mirrorless and DSLR together. Since 2003, 132.2m ILC cameras have been sold. Back in 2003 I predicted that the peak for ILC sales would come in 2011. I was off by a year. How did I predict that? By household penetration curve analysis. I looked at the film SLR household penetration numbers over time, then projected that forward onto DSLR household penetrations. (It’s possible that my “miss” by a year is no more than the Japanese keeping the throttle down for a year; see CIPA estimate comments, below.)

Here are ILC sales graphed for the last twelve years.

The question that we’ll start to get an answer to at CP+ later this month is this: how is the decline likely to flatten out? Each year at CP+ we get a forward estimate of unit volume and sales numbers. One problem with this estimate is that it is self-interested. More often than not we get the Japanese making close to what they estimate, otherwise the Nikkei stock market will start to react negatively when they are clearly going to miss their estimate.

Now let’s look at the final mirrorless/DSLR breakdown for 2015:

- Mirrorless — 3.34m units (25.6%)

- DSLR — 9.7m units (74.4%)

That 3.34m mirrorless total is divided by seven vendors. The DSLR total is divided primarily by two vendors, with two other vendors having minuscule portions of that volume.

Put another way, Canon and Nikon still share over 70% of the ILC market. The next closest competitor isn’t even at half of #2 Nikon’s market share (that would be Sony, by the way).

I’m placing my initial estimates for 2016 at these numbers:

- Mirrorless — 3.5m units (modest increase)

- DSLR — 9.2m units (modest decrease)

I tend to revise these estimates in May/June when I’ve had a chance to look at the final fiscal year information from all the Japanese manufacturers, and how they estimate forward. But I should note that all the fear mongering going on right now about the global economy is very much going to have an impact on 2016. The Japanese camera companies got burned by the Great Recession in 2008—see the “notch” in the graph above for 2009 where they finally reacted?—and I suspect they’ll be more cautious going into a headwind this time around.