BCN, the data monitoring company that reports sales in the Japanese home market for consumer electronics, posted their latest full year market share numbers last week.

Rather than just present the 2015 numbers, I thought I’d share with you the full range of numbers for three categories of cameras from 2005 to 2015. I start with 2005 because that’s when BCN broke cameras down from a single category to specific categories.

BCN has always reported the full year market share for the top three items in a category, which leads to some interesting points with cameras. Even though I have additional BCN numbers for other brands, I’m going to stick to the top three in each category here, as that’s what was published publicly.

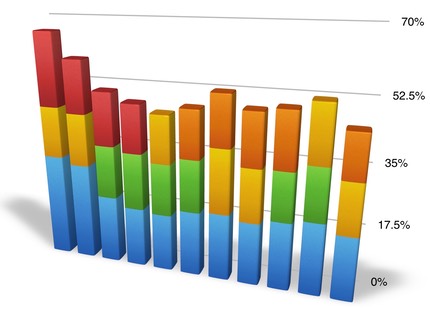

Let’s look at compact cameras first:

Left is current (2015), previous years to the right.

Blue is Canon, Red is Nikon, Gold is Casio, Green is Sony, and Orange is Panasonic

Things to note:

- Canon has always been strong in this category, but in the last two years has surged to dominance (30.5% in 2015)

- Nikon emerged from the mass of other contenders in 2012 has grown since (21% in 2015)

- Panasonic used to be a top three company, but no longer is.

- Sony used to be a top three company, but for the last two years hasn’t been

- Casio has fairly consistently been in the top three (14.8% in 2015)

More interestingly, the “Other” category—which includes all the players outside of the top three—has consistently declined from 2011 when it peaked at 54.1%, to the present when it now only 33.7%. The other players are scrambling for a smaller and smaller piece of the pie, and that’s not sustainable.

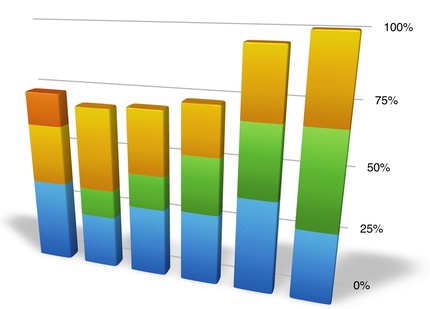

Up next, we look at mirrorless:

Left is current (2015), previous years to the right.

Blue is Olympus, Gold is Sony, Green is Panasonic, and Orange is Canon

Pretty obvious, isn’t it? Panasonic has been on a constant decline in its home market. Sony and Olympus have been battling back and forth for the first place spot, with Olympus getting the win in 2015 (34.5% to 24.8%). But look out, note how Canon suddenly snuck into the picture in 2015.

This brings up an interesting side point. The Japanese market is fairly price conscious. When you look at the low level BCN data, you see a lot of previous generation and discounted cameras pulling large volumes. Sony didn’t introduce a new APS camera in 2015, and the BCN numbers are all market share numbers, not dollar (yen) numbers. Which means the revised A7 models might have brought Sony dollars, but lost them market share.

Meanwhile, Canon introduced two lower end models (M3 and M10) in 2015. And the market share numbers seem to indicate that this succeeded (13.8%).

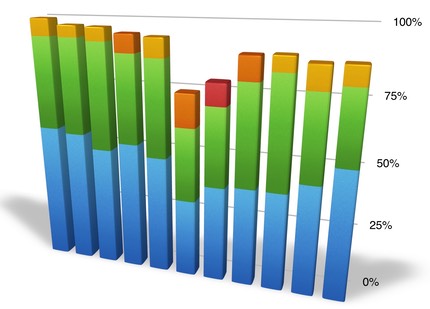

In DSLRs, things haven’t changed a lot in ten years:

Left is current (2015), previous years to the right.

Blue is Canon, Green is Nikon, Gold is Pentax, Orange is Sony, and the lone Red is Panasonic

Okay, this chart needs some explaining. The emergence of mirrorless in 2009 and 2010 had BCN including all ILC models together in the “DSLR” category for a couple of years. Thus the apparent dip for Canon/Nikon in the middle of the chart and the appearance of Panasonic.

Nikon has clipped Canon’s wings only once in DSLRs, and that was in 2007 (they also came extremely close in 2008). For the last three years, though, Nikon’s share has fallen (to 36.7% in 2015) while Canon’s has grown (to 56.2% in 2015). Sony fell out of the top three in 2013 and never returned, ceding the distant third place to Pentax (Ricoh) at 6.7%.

You have to be careful about reading too much into these numbers (they don’t represent 100% of the Japanese market outlets, for example), but still they provide a fascinating glimpse at what the Japanese camera makers are seeing in their own market. When you couple this glimpse with what I wrote about regionalization in today’s other article, you can get a sense of how complex the game being played really is.

Cameras are a mature and declining market that is provoking incredible competition between companies that were used to sharing a rising tide. One thing that is clear from the data is that Canon responds to any and all competition. They don’t like being #2, let alone something worse. Don’t expect them to sit still for anything competitors are doing.