Nikon today announced their second (fiscal) quarter financials. As usual, Nikon is the last of the major camera companies to announce financial results, so we have some ability to make comparisons.

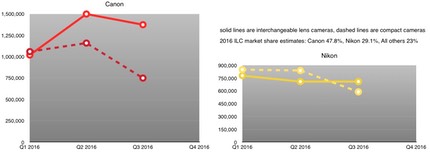

For example, here’s how 2016 is going for Canon versus Nikon in terms of unit volume (the same scale is used in both charts):

Note how far the solid yellow (Nikon ILC) line is below the red (Canon ILC). Just a decade ago those lines would have been pretty darned close.

If you graph dollars (yen) instead of units, the chart looks worse, which indicates discounting on Nikon’s part (and SG&A expenses have been going up, another indicator). Yes, it’s true that Canon’s sensor and part production wasn’t impacted by the quake as much as Nikon’s. Still, right now Nikon is hurting, and it shows.

How much?

So much so that the presentation was named “Financial Results for the Second Quarter…and Restructuring plan.” (Emphasis added.) Sales missed forecast by 5%, and the forecast was already 10% lower than last year. That’s a big miss.

Despite that, Precision group (semiconductor equipment) was up enough short term to offset much of the Imaging group downward numbers. Yet somehow Precision missed their forecast and underperformed ;~).

The financial presentation says that Nikon will discontinue their current medium-term management plan and restructure, including “a fundamental restructuring down to our management DNA is vital.” (Emphasis Nikon’s.) This also includes a “strategic pivot from revenue growth to profit growth” with priority of restructuring centered on lithography, cameras/lenses, and administrative HQ.

The “restructuring” bit seems unusual. Quite obviously, Nikon is still grappling with how to do it. Before Nikon made their financial presentation, Nikkei, a respected Japanese business publication, and Reuters both reported that Nikon would cut 10% of their domestic work force over the next two to three years. That’s about 1000 jobs, and most of them would probably be in the lithography portion of the Precision group, which continues to be a money loser. In Japan, losing a 1000 jobs is tough to do as you can’t just fire people without additional consequences, so speculation is that Nikon will be offering early retirement to a number of employees.

But Nikon fired back with an odd press release that contradicted their presentation saying there would be no headcount reduction. The presentation, though, included the words “headcount rationalization and re-assignments of 1,000 employees [in lithography and] 350 employees [in imaging products].” It’s difficult to tell whether Nikon management is playing with semantics and trying not to fall short on Japan business regulations, not yet in full agreement with exactly what they’re going to do, doesn’t yet know what to tell employees, or whether management itself has a leaker trying to leverage political advantage.

Meanwhile, the Imaging group restructuring will “focus on high value-add products,” reducing staff, “optimize sales and manufacturing structure,” and “reassess business organization and structure.”

Management bonuses are forfeited. Salaries reduced. And curiously the number of directors and officers may be reduced. This looks as punitive as you ever see a Japanese company: fingers in Tokyo are being pointed as to who failed and why.

And yet, everything I read or heard in the presentation seems like entrenching to me, which is not what Nikon truly needs, IMHO. If we’re to believe the Nikon financial numbers, here we have a profitable company with good free cash flow and other metrics that is acting like the sky is falling. Readers of this site know that I’ve been critical of Nikon management for some time. Nikon is overloaded with consensus management at the top, and failed to innovate and hold off a new competitor in semiconductor equipment (and losing market share), and now they’ve failed to innovate and hold market share in a market in which they’re part of a duopoly. This is classic management failure.

So let’s look at the forecast for the rest of the year:

- 3.2m ILC units (27% market share)

- 4.7m lens units (24% market share)

- 3.5m compact cameras (26% market share)

Nikon is going into their 100th anniversary year (2017) looking wounded. They’ve dropped market share by a significant amount. The question is what will they have to do in 2017 to make the anniversary look special? Or will it be a party that no one was happy to attend?

Side note: I was surprised to see in researching this article that there is a common-suggested anniversary gift for the 90th anniversary (diamond+emerald) but no 100th anniversary suggestion. Now I don’t know what to get Nikon! ;~) Technically it would be my 50th anniversary of using Nikon cameras, so I’d like to give them a gold star, but only if they behave. ;~)

- DLs and KeyMissions are new and important initiatives for Nikon. One needs fixing, the other actually needs to ship.

- Coolpix has collapsed. It’s time to call a Code Blue and get the crash cart.

- DX is slowly getting marginalized by competitors. New lenses and a full lens set (buzz, buzz) or:

- What is Nikon’s mirrorless solution?

- FX just needs a refresh of everything other than the D5 (though I’d like a D5x).

- SnapBridge is barely communicating. Get it out of the corner and talking to everyone.

- Video is “only a red button” to Nikon. To potential video customers, it needs to be so much more.

Based on Nikon’s restructuring plan, my guess is that the FX refresh is now getting priority. Remember “high value-add products.” Okay, Nikon. Give us a D5x; a pair of D850s, both with the new technology (AF, metering, etc.) with one having the D5 sensor the other a new high-pixel count sensor; plus better D750 and Df replacements. That would be a start.

But it really doesn’t address the problem I’ve been writing about for almost a decade now. Iterative product are getting fewer and fewer upgrade takers moving forward. What we need is something that’s so compelling in solving key critical user issues that we all want the new thing. Oh, and more DX lenses (buzz, buzz).

Just a reminder: Nikon is still a profitable company, and according to the numbers, healthily so. They’re not going out of business. But as I predicted, they’re getting smaller.