Nikon this week has put out a series of announcements, including the release of their fiscal year Q3 financials.

The big news started with a declaration of additional “extraordinary loss,” an accounting term for a loss that is unusual and not caused by operating activities. In other words, a write down of previously declared values. Nikon had already suggested that this write down was coming, but they’ve now not only confirmed it, but increased the amount by 5 billion yen.

Much of this loss is due to restructuring, particularly in the semiconductor equipment division. The really strange aspect of this is that operationally that group produced 154% in net sales gain during the quarter on a year-to-year basis. So Nikon’s announcement can be confusing: it looks like results for that group are good due to increased sales, but the value of many assets and the restructuring they’re doing in the business is going to basically wipe all that short-term improvement out and then some.

This was expected, though the level of it is slightly higher than expected.

The shocker in the news this week was the cancellation of the DL model line. Nikon’s own statements about that were slightly inconsistent. In the short post on their site, they mentioned "canceled due to concerns regarding their profitability,” which implies that they would have been unprofitable. But in the general presentation to the Japanese press the wording was slightly different: "Canceled launch of lower profitability products,” implying that there might be profit, but not at the level Nikon wants to produce. More on that in a bit.

Within the same part of the presentation was the official word that the KeyMission cameras were indeed not selling well. Curiously, they were not cancelled. Nor was there any mention of potentially cancelling any Coolpix models.

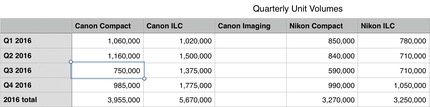

It’s time to do some comparison of what happened in 2016 with both Canon and Nikon. Here are the basic numbers quarter by quarter:

Nikon did a big push for the Christmas season, but still ended up with a reduced market share for the year. Here’s what things look like graphed:

The thing that strikes me is that there is probably still bad news in the Imaging business that hasn’t surfaced yet. Note that surge in unit volumes for the last quarter from Nikon: all the evidence I have from the retail channel is that there wasn’t a corresponding sales surge to customers, meaning that this was really push of inventory into subsidiaries to get it off corporate inventory. SG&A expenses keep going up, too, which suggests Nikon is having to discount more heavily to move that extra inventory they’re pushing into the channel.

Despite that surge, the overall numbers for the first three quarters of Nikon’s fiscal year are weak year-to-year for cameras and lenses: net sales down 29%, operating income down 18.4%. Nikon’s still running a high single digit GPM in Imaging (24.2b yen income on 300.8b yen sales), but the size of the pie is getting smaller.

I’m still trying to analyze the exact numbers, but the thing Nikon didn’t report but is essential to understanding where they are is this: Nikon lost ILC market share in 2016. Thus, their claim that it’s the declining market that defines their problem is not exactly true. Nikon is declining faster than the market in ILC, their primary brand driver. Coupled with no decline by Canon during the same time period, and we have a return to the 90’s: Canon has about half the ILC market, and Nikon about half of the remaining half.

So before moving on, let me summarize: Nikon is still decently profitable, but shrinking. The extraordinary loss might be a one-time thing that allows them to stabilize at that smaller size; but they might continue to shrink. Everyone worrying that Nikon is going away soon or will be acquired or will stop making cameras should settle down and relax a bit. Things are not dire.

That said, I have to tackle the DL cancellation, because if it was done for the reason Nikon suggests, Nikon management is making their problems worse, not better.

What all of the Nikon presentation in Tokyo reiterated—for the nth time—is that Nikon is filled with bean counters who micromanage. Nikon appears to be looking at products in isolation, which is in my opinion dangerous and has potential for creating new, bigger problems.

Personally, I thought that Nikon had learned something when they presented their marketing for the DLs at the original announcement. Remember all the “compact for a DSLR shooter” types of comments they made about the design and how they approached creating the product? Dead on. Every serious shooter I know—every darned one—wants a camera that works the same as, uses the same accessories as, and functions the same as their main DSLR camera. But it must be compact and thus able to fit in a small bag or even a jacket pocket so as to be carried everywhere.

Right now, Nikon DSLR users are picking non-Nikon products to do that with. So the compact camera they choose doesn’t work the same, doesn’t use the same accessories, and doesn’t produce the same results. Not. What. They. Want. Not what I want, either.

The DLs potentially represented a breath of fresh air: EXPEED (same results), DSLR-like menus and controls (works the same), and used the Speedlights (same accessories) among other things. We can argue about whether the two smaller DLs should have had RX100-like built-in EVFs instead of the optional external ones, but for the most part, everything Nikon seemed to be doing with the DLs was the correct product line management decision making. Compacts targeted for the core Nikon user.

First, I think Nikon would have sold more of those DLs than their own antiquated, political, and paternalistic demand analysis appears to have said they would. I can’t speak to “profitability level” a DL might achieve, but I do think the models would have decent sales. I know an awful lot of folk that bought a Sony RX or a Panasonic and don’t like the results. They’re ready to switch back. Plus, the DL 18-50 would have been a unique product that once word of mouth validated the lens probably would have exceeded Nikon’s expectations by a large margin. (I had talks with a couple of Nikon execs about this; they did not believe what the survey of my site readers showed in terms of the DL 18-50 purchase likelihood.)

But here’s something more to the point: Nikon keeps thinking about cameras, not customers. That was clear with the way the Nikon 1 was handled, the fact that we got the KeyMission series, and even to some degree the way Nikon has been iterating DSLRs. To me, the DLs being a compact extension for a DSLR user was the first statement I’d seen from Nikon that seemed to consider the customer first rather than the camera. Otherwise, the DLs could have just been a J5 with a fixed lens and on the market long ago.

My fear is that Nikon management is making terrible product decisions based upon the wrong assumptions and reasons.

Look at Canon: we’re slowly seeing them develop into a 1”, APS mirrorless, APS and full frame DSLRs range of cameras that work similarly, use the same accessories, and produce similar results (DIGIC). Yes, the EOS M5 I’m testing right now has a subset of the Canon DSLR menus, but it’s a well-considered subset and I was able to immediately pick the EOS M5 up and begin using it well because I had familiarity with the DSLRs. There’s only one thing I haven’t figured out how to change on the camera, and that’s a unique feature to the EOS M5.

Where we are with Nikon is this:

- An FX line that sells modestly well (and decently against Canon), has mostly strong choices, and is probably on a standard iteration schedule now.

- A DX line that is starting to sell less well—especially at the low end—and doesn’t have a full set of lenses so can’t defend against crop-sensor mirrorless (buzz buzz). But at least iteration is on a regular schedule again.

- No mirrorless line with a reasonable-sized sensor.

- A mirrorless “line” with the smallest sensor, an odd set of lenses, that doesn’t use DSLR accessories, that is overpriced to the competition, which Nikon doesn’t promote any more, and which most dealers won’t stock.

- No serious compact line.

- Action cameras that really aren’t doing well, which were late to market with too little, and which rely on software that is flakey and immature, at best.

- Some random Coolpix, most of which have no real visibility in the photography market, and certainly none of which match up with Nikon’s DSLR strengths. I’ve written before that Coolpix was hurting Nikon’s brand reputation, and now that’s especially true.

Last week I offered my product plan for Nikon. That was an attempt to fix the things that Nikon already offers. But if Nikon really wants to shrink and do everything right in a new smaller corporate size, then the plan is far simpler:

- Continue with FX as I suggested.

- Rationalize DX fast. Three cameras, build out full lens set.

- Create a DX mirrorless that replaces the D3400. Use DSLR-like controls, accessories, performance. Lens road map absolutely necessary.

- Create what the DLs would have been: one, two, or three serious compacts that are as close to the above three lines, but compact in size and high in performance. Add an AW model.

- Kill KeyMission.

- Kill Coolpix.

- Kill Nikon 1.

But the downside to downsizing is this: every product has to be dead on for that to work. That means that Nikon needs to understand their customers better, and get better feedback on what is and isn’t important. It means that we can’t have more repeats of the D600, D750, or D800 QC problems. It means that we need road maps for lenses. It means that things like SnapBridge have to actually work when they come out. Support has to be there, and marketing has to be on target.

How much Nikon will shrink is dependent upon those things.

Errata: an earlier version of this article misstated the percentage net sales increase in the Precision division.