Nikon has updated their stock information information after their final year-end board meeting. It's illustrative of the "problem" Nikon is managing to.

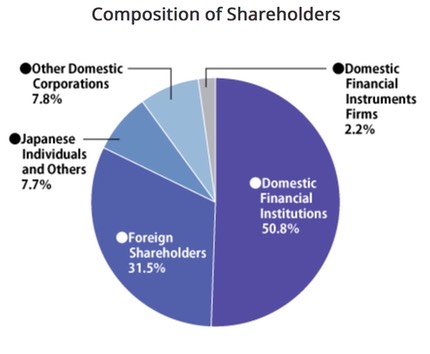

First, here's the breakdown of the shareholders at Nikon:

Note the heavy reliance on Domestic Financial Institutions. That, in a nutshell, is now Nikon's biggest problem.

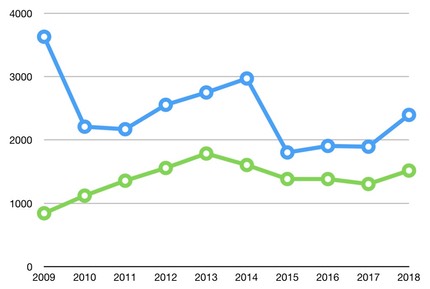

Why would that be? Let's look at another chart:

The blue numbers are the annual high for the Nikon share price, the green is the annual low. Note something interesting about the low the past five years: it's been a floor. My bet is that all those financial institutions that own the majority of Nikon have an asset price on their books of around 1300 yen on the stock. If the price were to fall below that, they'd be losing money on their investment.

So how do they make money? Remember, in Japan the central bank has interest at a negative number, and has for some time now (it's been -0.1% since the start of 2016). Financial institutions in Japan have access to "no-cost" money.

All those banks owning Nikon get rewarded if: (1) the stock doesn't fall below their buy-in price; (2) Nikon is paying back its loans and bonds; and (3) Nikon pays a dividend. Nikon's current dividend is about 0.8%. That's way higher than the 10-year bond rate in Japan.

Short version: Nikon is being managed to shareholder needs, not business needs.

The problem at Nikon has been and continues to be business contraction. First it was that the Precision division fumbled the semiconductor equipment business badly, more recently it's been that Nikon fumbled the camera business badly.

Now I'm sure that some are immediately saying "but Thom, the camera business is still profitable." Sure. But in a time where Nikon's two biggest competitors matched or grew their camera business and retained or increased profits, Nikon contracted. In both compact cameras and ILC the biggest loser in the overall market contraction has been Nikon. You can add action cameras to that, too.

That points to a company that's slow to recognize marketplace and customer changes, and it maps almost exactly to Nikon's previous troubles in the semiconductor business, which was its bigger business before digital cameras took off.