News/Views

Nikon Adds Some DSLR Rebates

NikonUSA is now (starting Monday May 30th) promoting a number of key DSLR lenses at strong discounts:

- 200-500mm f/5.6E — US$340 instant rebate reduces the price to US$1059. This is the budget zoom telephoto to own. Competent at all focal lengths, hand-holdable, and at this price, a bargain.

- 24-70mm f/2.8E — US$500 instant rebate reduces the price to US$1599. This was the best of the mid-range zooms Nikon made, though a little on the "big" side. At this price, everyone would have bought one when it first came out.

- 70-200mm f/2.8E — US$450 instant rebate reduces the price to US$1899. Sensing a theme? Nikon's put some of their best recent F-mount optics up with substantive discounts. If you're a DSLR user and don't have an f/2.8 telephoto, now's the time to pick one up.

- 500mm f/5.6E — US$300 instant rebate reduces the price to US$3299. This is a solid lens that, due to its fresnel lens, is short and light for the focal length. Very hand holdable. Both DSLR and mirrorless users have this lens in their kit for good reason: it's the best way to get to 500mm with high quality without breaking the bank (or your back).

- 14-24mm f/2.8G — US$400 instant rebate reduces the price to US$1399. This is a workhorse wide angle zoom that, once you get past the field curvature, can net you great wide angle images in low light.

Before people start hypothesizing that this is the end of the line for these lenses, consider that the yen/dollar relationship has tilted dramatically in the dollar's favor recently. That, coupled with the fact that Nikon probably would like to clear out some F-mount inventory they've been building up probably explains these deep discounts. Oh, and Nikon controls most of the parts in these lenses, and thus likely doesn't have the supply chain problems they have with some of their camera offerings.

Other than perhaps the 200-500mm, I don't expect these lenses to go away any time soon. The three f/2.8 lenses, for instance, really need to stick around to sell the FX DSLRs out through 2026 as Nikon expects. And the 500mm f/5.6E fills a role in both the F-mount and on an FTZ adapter on the Z-mount.

So, sales like this are a way of taking advantage of Nikon's short-term tactical shifts.

Click this link to purchase one of these lenses from this site's exclusive advertiser.

First "Hard" Information on Nikon DSLR Life

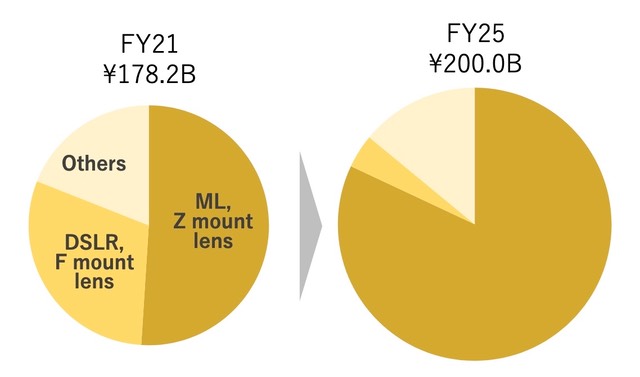

Updated: it appears someone got their dates wrong in the above chart: FY21 should be FY22, and FY25 should probably be FY26. I've adjusted my dating below.

There you have it (from Nikon's Investor Relations Event on May 26, 2022).

You probably need some help parsing this chart, so let me try.

FY21 actually refers to the year ended March 31, 2022. In that year, the F-mount cameras and lenses accounted for about 30% of Nikon Imaging's sales, or something close to 53b yen.

FY25 actually refers to the year ending March 31, 2026. By that point, F-mount cameras and lenses will account for just less than 5% of Nikon Imaging's sales, or something below 10b yen.

Put another way, in the next four years Nikon will be phasing out DSLR sales, though not discontinuing them completely. Given Nikon's stated "concentrate...in high value-added products", it would suggest that the three current FX DSLRs (D780, D850, and D6) and the primary, best-selling side of the FX lens set are likely to be the products that remain in the lineup through 2026.

Some of you will take this as "bad news." I actually take it as "good news." The fear has been that Nikon would just summarily discontinue DSLR products at some point in the near future. While that seems likely for DX, the fact that there's a clear tail of sales out for another three years indicates that the FX side will likely just be allowed to taper naturally. Put another way: Nikon's DSLR future is actually up to you, the customers. Keep buying and Nikon just might encourage that tail to continue past 2026. Stop buying, and Nikon will see that as a message to close the DSLR shop.

The "Available" List Dwindles

Let's look at the Nikon DSLR lineup as of today:

- D3500 — readily available

- D5600 — body only is drifting in and out of inventory, but body+lens kits readily available

- D7500 — body only is drifting in and out of inventory, but body+lens kits readily available

- D500 — limps in and out of inventory; seems to be built in low quantity at the moment

- D780 — readily available

- D850 — has a big discount at the moment; but has been in and out of inventory for months

- D6 — seems to be readily available

Essentially the full current body lineup is available. In the recent past we've seen the Df, D610, D750, and D5 leave the scene. Rumors keep popping up about another DSLR body going out of production, but looking at Nikon's latest financial numbers, they're still selling quite a few DSLRs. The problem for Nikon is that in order to remove a model, they'd need stronger mirrorless offerings at that same or higher position. Realistically, only the D6 has that (Z9), but there's no way the D6 is going away soon. It's a low volume flagship that is likely to be one of the last to leave the building.

That said, Nikon doesn't have much "old model still available" happening in the DSLR lineup anymore. At one point, we had three generations of DSLRs being sold at the same time. Today, it's just the current generation, with the D780 and D850 bodies being the only ones with any instant rebate. I expect that to be a similar story through the rest of this year.

Many F-mount (DSLR) lenses are still available, with NikonUSA showing 90 such lenses still being sold. That list is a little deceptive, though. A number of those are duplicate DX lenses (four 18-55mm!). Some are lenses we've seen discontinued in other countries. The Japanese Web site is probably a better indicator of "still available", and it's listing 83 lenses, though some of those also appear in the "archive" list, which tends to mean production has been stopped even though sales might continue for a short period.

My best guess is that about 50 F-mount lenses remain in active production at the moment. Old technologies are clearly being slowly removed (e.g. D-type lenses), as are some poor selling G-type lenses. The lenses that seem to be relatively immune from discontinuation are recent E-type lenses. That actually makes some sense, as they're also the ones that work best on the mirrorless bodies (electronic aperture control, not physical).

The problem, of course, is that "interchangeable lens camera" is a chicken-and-egg proposition: no bodies means that lens sales tank. No lenses means that body sales tank. Nikon seems to be carefully and slowing cleaning the cupboards of their older gear, trying to leave a viable set of body/lens choices that are trimmed down, but not so much winnowed that no one wants to buy into DSLRs at all.

I don't think 2023 is going to be kind to Nikon DSLRs, at all. Nikon has said that they are now at the point where they can make their desired profit on only 150b yen worth of sales. That's the level of sales Nikon did in their previous fiscal year (April 2020 thru March 2021). In the fiscal year just ended (March 2022), Nikon Imaging was at 178.2b yen in sales. So I think one of the factors with Nikon DSLR continuation is how fast the mirrorless part of the imaging business grows to be close to that 150b mark. They're clearly not there at the moment, and the parts procurement problems prevent them from moving faster on that front, so I suspect we're going to see the DSLR line just continue to slowly winnow for the next three years before we reach the point where Nikon will say "time to close it down." (More on that at the end of the article.)

The tricky part is that D780, D850, and D6 sales compete with the stronger side of the mirrorless line (FX from Z5 to Z9). Nikon's DX DSLR line is actually stronger than their mirrorless DX line, both in bodies and lenses, and that's where a lot of the unit volume is still happening. I believe that about a third of Nikon's ILC body volume is probably in the D3500 to D500 DSLR lineup still. Until Nikon shows a more concerted Z DX effort, I'm not sure how Nikon can transition away from DSLRs. The Z5 to Z9 lineup won't produce that 150b yen sales level on its own, methinks.

Canon is more difficult to figure, as they have a real scattergun approach to interchangeable lens anything (still or video) as I write this (though that may change with RF S models about to appear, and the recent appearance of cinema RF). Here in the US the Canon DSLR line now seems to be:

- SL3

- T7

- T8i

- 90D

- 6D Mark II

- 5DS R

- 5D Mark IV

- 1D-X Mark III

That's one more model than Nikon is serving, but a lot of those Canon DSLRs are truly limping along in sales at the moment, and I wouldn't expect that many DSLR models by the end of the year still being actively sold in the US.

Like Nikon, Canon has been cutting out a number of older DSLR lenses. I count 76 EF lenses still being promoted, but only about 50-60 of those seem to be still in serious production.

Thing is, for the first three months of 2022, it seems that only 56% of the interchangeable lens cameras (ILC) shipped by the Japanese companies were mirrorless, meaning that nearly 44% of the ILC shipped were Canon and Nikon DSLRs. Of course, the average selling price of the mirrorless cameras was well over 4x higher than for those DSLRs. That is the real dilemma for both Canon and Nikon: they're still selling a lot of APS-C (DX) DSLRs, but neither company has a huge mirrorless unit volume going yet. Frankly, no one does. It's why Nikon is pushing Z9's so hard: low volume but high sales price and high profit margin. Sure, they'll only sell 40-50k units in the first year, but those all have a nice markup on them. 50k units also gets Nikon almost 10% of the way to their 150b yen minimum sales need.

FWIW, Nikon's just published forward estimate of camera sales for the coming fiscal year is basically flat in terms of unit volume (700k ILC, 1.25m lenses), but predicts an 18% increase in revenue and 16% increase in profit. This implies that the mix of cameras and lenses sold will go further upscale from where it currently is. The Z9 is only part of that. It appears that Nikon thinks that at least another model (or models) will pick up their average sales price. Short answer: fewer DX DSLRs, more FX mirrorless.