BCN has released their year-end retail sales rankings for the Japanese market for 2016. While the mirrorless numbers get written about a lot, the DSLR numbers are even more illuminating. A reminder: BCN is an organization that tracks cash register receipts in Japan. Their data is based on actual sales to consumers. Let's take a look, shall we?

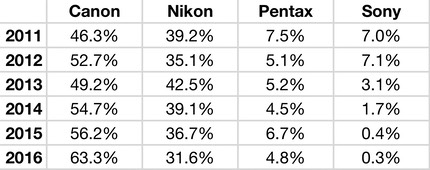

In their home market Nikon is losing market share to Canon, and fairly convincingly over the past four years. Coupled with Sony's total slip with the Alpha series, Canon has now surged to almost two-thirds of the DSLR sales in Japan. Pentax, meanwhile, is bouncing around in a fairly narrow single digit market share, dictated a bit by when they launch new consumer-oriented DSLR products.

The less-than-lukewarm model updates that produced the D3400 and D5600 aren't going to help in 2017, as much of the market share is price sensitive: the D3300 and D5500 were already not holding serve in Japan, and adding SnapBridge isn't likely to change that.

As readers of this site well know, I'm strongly negative about Nikon's relationship with its customers here in the US. We've had a long erosion of customer service and support, while customer outreach has essentially turned to zero. A lot of that has to do with the pressure on the subsidiary to cut costs. But meanwhile, the corporate entity is culturally isolated in Japan and gets virtually all of its product feedback from a subsidiary that no longer has a good customer interaction. Bad news.

But what's the excuse in Japan? ;~)

Canon's now outselling Nikon 2:1 in their home market. Is the Japanese management at HQ not hearing the customers that surround them every day and speak their own language? Quite obviously, Nikon is failing to connect to customers, and not just in the US, but at home, too. Whether that's due to price, product, or promotion I can't say for sure, but something isn't working, and it's not working right in front of Nikon management's eyes. All they have to do is hop on the Hibiya subway line and walk into the stores in Akihabara and they can watch the disaster unfold in real time.

Meanwhile, Nikon doesn't show up in the top three for mirrorless cameras according to BCN, which means that Nikon's ILC market share is going down in the home market, too. Somehow Nikon has managed to retain the number two market share in compact cameras—though remember that market is getting much, much smaller every year.

But let's look at lenses: oops, Sigma now has moved into second place and pushed Nikon to third in the Japan market. Again we see strong erosion. Nikon had 23.2% of the interchangeable lens market in 2009. Let's look at the yearly numbers since: 20.4, 19.7, 19.6, 18.9, 15.2, 15.2, and last year 12.5%. That look like a strong showing to you?

Note that I mentioned three factors earlier: price, product, and promotion. Some combination of those things is making Nikon fail in their own country, and it's not a sudden failure, it's a trend that has been going back as far as we can measure it.

The bigger problem, of course, is that the camera market itself is shrinking. Thus, when you perform poorly, even if you are able to eventually fix those problems, you might not grow overall. The market shrinkage might eat up the volume growth. But what's happening to Nikon is far worse: they're losing market share in a shrinking market. While I don't have retail numbers for the US and Europe for 2016 to look at yet, you can verify that this is a worldwide trend for Nikon just by looking at the CIPA shipment numbers coupled with Nikon's own detailed financials: Nikon is losing market share in ILC cameras and lenses.

So enough is enough, I say. It can't be that Nikon corporate doesn't see the problem, as they've just had a major entity in Japan show them the embarrasing numbers, making public their failure, even though no one in Japan is using the word "failure" yet. The question is this: what are they going to do about it?